Quantum Computers Market Landscape

Chapter 4 of the Quantum Computing Series. Discussion about types of quantum computers market, and the ecosystem of quantum software and hardware, with Joel Pendleton of Conductor Quantum

About the Quantum Computing Series

Understanding quantum computing requires understanding multiple disciplines. That’s why I’m so drawn to write about this topic, but also why I like to invite experts to the discussion. In this chapter, I talk to Joel Pendleton, who withdrew his Oxford PhD to build Conductor Quantum - a company creating quantum computers on silicon chips.

Enjoy the reading & see the complete Quantum Computing Series listed at the conclusion of this post.

Quantum Computers Market Landscape

The quantum computing ecosystem is surprisingly diverse. While most media attention focuses on the race to build working quantum computers, the market involves many specialized players, from cryogenics and control electronics to specialized software. Understanding this landscape helps reveal where real innovation and financial opportunities currently exist.

Reading

CHIPS and Science Act on Wikipedia

Discussion with Joel

I haven’t found a trustworthy source that would provide overview of the quantum computing ecosystem. Are there a lot of tools being built, or is everyone just building mostly quantum computers? What does the landscape look like?

Quantum computer providers based on Google

The quantum ecosystem includes various specialized companies beyond just quantum computer manufacturers. While major tech companies like IBM, Google, and Microsoft are building quantum hardware, many startups focus on specific components of the value chain - quantum software tools, control systems, error correction techniques, or application-specific algorithms for industries like finance or drug discovery. There's also a growing segment focused on quantum sensing and quantum communications technology, which may reach commercial viability sooner than full-scale quantum computers.

Conductor Quantum, your company, is building software to model the process of what humans normally do with quantum computing. Why exactly do we need better software for this?

A lot of physicists don't automate their workflows. They often get the necessary data, perform the sweeps, take the measurements from the experiments, and analyze them manually.

What we do as a company is use machine learning and different software approaches to analyze the data in real time, choose the parameters, and keep the qubits at high operational or low error rates. It's funny because in principle, anyone can do it, but our advantage is that we spent the past eight years of our lives-combined working on this problem. We're tackling the problem in a completely different way from everyone else.

There are other benefits to this software-first approach as well. When manufacturing quantum computing hardware, we're essentially creating physical quantum bits (qubits) on semiconductor wafers—thin slices of material like silicon used to fabricate integrated circuits.

If you develop a qubit design that isn't optimal, it can be extremely challenging to identify improvements manually, especially when you're fabricating trillions of these individual qubit devices on a single wafer. This is where our software solution becomes invaluable: it can rapidly simulate and iterate through countless design variations to determine the most effective configuration without needing to physically manufacture each test version.

The benefit of our approach is twofold: first, we can successfully create functional qubits with optimized performance characteristics, and second, we can implement these improvements at scale across the manufacturing process—both crucial requirements for practical quantum computing.

Besides the software, are you also building your own quantum computers?

We work with our partners who specialize in making chips and we develop the software for them that can precisely tune the qubits, keep them stable, and minimize their error rates.

This approach offers several important advantages. One of them is scalability - you simply can't build a practical quantum computer if you're manually tuning each individual qubit and its associated components. That's been the approach many scientists have taken with spin qubits until now, but it's not viable for systems with hundreds or thousands of qubits.

Another advantage is rapid iteration on device designs. We can use our control systems to test and refine different qubit configurations without rebuilding physical hardware each time. This approach could even benefit classical computing by helping develop more efficient transistors through similar optimization techniques.

This being said, do you see your company in the long run more as full-stack, hardware-oriented, or software-oriented?

We're a software company, which we excel at. It’s an underappreciated area in quantum computing—our focus is on creating what's essentially a BIOS for quantum computers. Similar to how a computer BIOS manages the fundamental communication between hardware components and the operating system, our software interfaces directly with quantum hardware to optimize performance and make the underlying technology useful.

This approach leverages our semiconductor quantum device backgrounds. It also allows us to make meaningful contributions to the field with significantly less capital expenditure than companies building complete physical quantum systems from scratch.

Should I look at Microsoft and other giants in this space as your users or more like competitors?

We're competitors in a sense, though we’re betting on different approaches. Microsoft is developing comprehensive quantum hardware in its labs focusing on Majorana qubits, while we (Conductor Quantum) specialize in quantum dots and spin qubits in semiconductor devices.

Interestingly, there's potential for technical crossover—Microsoft has research on using quantum dots to read Majorana fermion states, and we might eventually adopt some of their sensing techniques for measuring quantum states in our systems. These complementary approaches appear in research literature, though Microsoft is likely focused on building its complete proprietary stack.

Competition aside, it's exciting to see quantum computing capturing the public's attention. Even if the media portrayal isn't always 100% scientifically accurate, anything that gets people interested in quantum science is valuable. That's ultimately what matters—inspiring the next generation of scientists and engineers.

If a big part of quantum computing hardware is still years from major revenue, what's the fastest path to making money for a new startup in this space?

Making something people want. Three things come to mind, fridges, control electronics and control software. The players who are currently making money are the people who sell the fridges to cool the devices (the qubits and their associated electronic systems) down. For example, Oxford Instruments and BlueFors have recorded hundreds of millions of dollars in sales in the past year. For many of these quantum devices to operate, you need extremely cold temperatures, close to absolute zero - cold enough for space. The fridges require liquid helium and use the dilution of different isotopes of helium to cool the systems down.

Each fridge is really expensive to build, but there's a huge markup on them, and a bunch of companies are doing it. For example:

BlueFors - based in Finland

Maybell: A fast-moving Colorado-based startup, who are growing quickly.

Oxford Instruments: UK-based company with significant sales

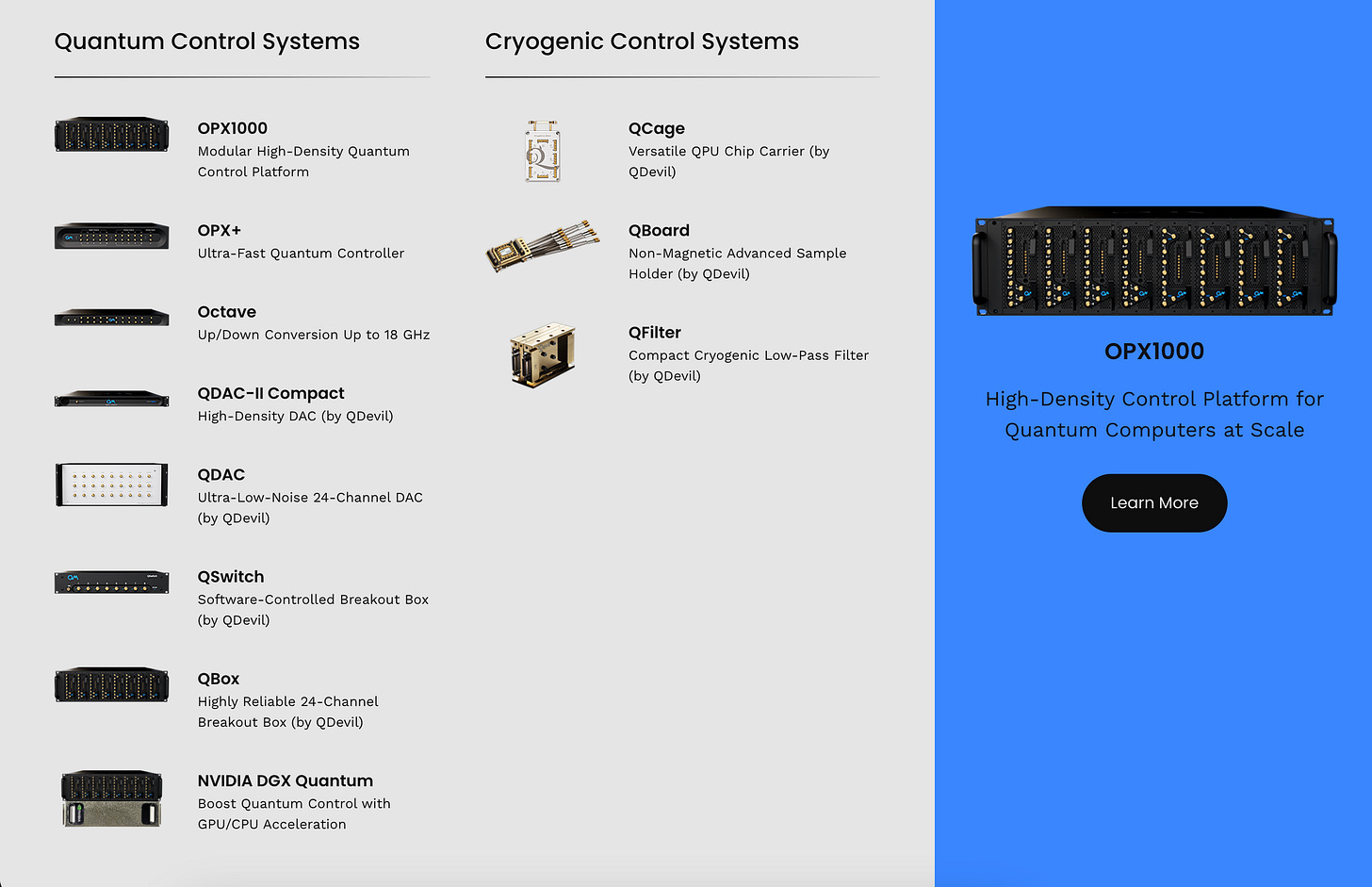

Then there's also the control electronics - the electrical requirements for quantum computers are way more stringent. We need to send microwave signals or very high-frequency signals that are hard to have with low levels of noise. There are loads of people building such infrastructure, for example:

Quantum Machines: Israeli company that's raised a huge funding series

QBlox: Based in the Netherlands

KeySight Technologies: Established test and measurement company

Zurich Instruments: Swiss company specializing in quantum control electronics

Finally when it comes to control software, we are the pioneers for building control software for semiconductor spin qubits. There are other companies such as Q-CTRL and Riverlane that look more at the error correction part of the software stack.

What about the big players building both the quantum computers plus the software?

There are loads of companies that are trying to build full-stack quantum computers. They aim to make the quantum computer available on websites so researchers can run an algorithm. Here are some of the most known, based on the quantum computing approach:

Big Tech Players:

Google

Microsoft

IBM

Spin Qubit Companies:

Diraq

Quantum Motion

Silicon Quantum Computing

Superconducting Qubit Companies:

Rigetti (based out of Berkeley)

Oxford Quantum Circuits

Atlantic Quantum

Neutral Atoms

Atom Computing

QuEra

How do you see the quantum computing ecosystem changing in the future?

I think we’re going to see more companies focus on a specific niche rather than try and build the entire quantum computer themselves. Whether it is the control electronics, the processing units or quantum algorithms - the industry will get more fragmented as companies specialise.

I'm surprised that so many companies are building entire quantum stacks independently. For example, if we compare it to AI agents, developers quickly learn to outsource tooling rather than maintaining everything in-house. Given quantum computing's extreme complexity and requirements for specialized expertise, this is just not intuitive to me.

This is because in the AI agents field, you use GPUs as hardware. And there already is one company that does GPUs really well and has basically captured all the market - NVIDIA. No one's achieved an equivalent of this for quantum yet. It was the same with CPUs back in the day - it was all Intel. Over time, it fragmented slightly, but still, now there are only a few dominant companies.

What do you think will happen to the quantum hardware vs software landscape? Would you bet on someone particular winning there?

I don’t have particular guesses but my prediction is that the hardware ecosystem is probably going to stay as oligopolies, while the software side of things is going to be a lot more fragmented in the future. That’s because the barrier of making or reproducing software is so much lower compared to hardware. The reason hardware companies have such a big moat is that it's so hard to build, but we’ve seen that change over time with the classical computing industry, look at Intel for example.

Part of our job at Conductor Quantum is to make the hardware easier to use. In a sense, that's one of our deep missions, and part of it is also to ultimately build a full quantum computer that is usable. The fundamental goal is to make the hardware as easy as possible to use.

Talking about hardware being difficult, the ingredient that you need most is the silicon, which, if I am correct, is manufactured mainly in Asia. How is the US currently trying to have a stronger position as a silicon producer?

Silicon chip production is a national security problem. Quantum technologies are restricted and are under export control - you are not allowed to reveal too much. For example, you get in trouble if you send classified docs over e-mail to certain countries. It follows similar rules and regulations as the space industry.

Taiwan and Korea host the world's largest chip manufacturers, with Taiwan producing the majority of advanced chips for global tech companies. The US is actively working to reduce its dependency on Taiwan. China's territorial ambitions toward Taiwan create additional urgency—if China were to gain control of Taiwan, it would effectively control the world's most critical semiconductor supply chain. This geopolitical reality is driving major US investments in domestic chip production capacity.

What big steps has the US taken in this direction?

The US has invested heavily in chip production on home soil, the initiative is called the CHIPS Act. There's a lot of money being invested; Intel, Broadcom, and other companies received incentives to produce more chips. Also, a Taiwanese company called TSMC is now building more fabs in the US.

"Fabs" refers to semiconductor fabrication plants (fabrication facilities), which are highly specialized factories where computer chips, processors, and other semiconductor devices are manufactured.

The challenge for US quantum computing companies is securing manufacturing capacity at advanced chip factories. Quantum chips need slightly modified fabrication processes that differ from standard computer chips. Getting manufacturing contracts is expensive and complicated since major fabs prefer high-volume standard production. Despite these hurdles, this investment is worthwhile – once manufacturing relationships are established, the existing semiconductor infrastructure could potentially produce billions or trillions of quantum devices.

This is also a geopolitical issue because chips have become the most critical technology of our era. They're now essential infrastructure - just look at San Francisco, where computing power is so ubiquitous you can't walk a few meters without encountering a startup using GPUs powering their applications.

Read more of the Quantum Computing Series:

Chapter 1: Microsoft And Google's Quantum Launches

Chapter 2: Building a Quantum Computer

Chapter 3: Types of Quantum Computers

Chapter 4: Quantum Computers Market Landscape

Chapter 5: Topological Quantum Computers Explained

Resources to start with quantum computing

What Quantum Computing Isn't by Scott Aaronson

Learn the Algorithms Behind Quantum Computing by Beau Carnes

Landscape of Quantum Computing in 2024 by Samuel Jaques

Quantum Computing on Wikipedia